Expenses allow you to capture the billable and non-billable costs that you incur as part of your project work. These non-labor expenses are usually itemized costs for things like materials, travel expenses, or fixed-fee services. Typically, billable expenses are passed on to a client or customer, whereas non-billable expenses are internal costs paid for by your employer.

This feature is available in Enterprise edition workspaces.

Adding Line-Item Expenses

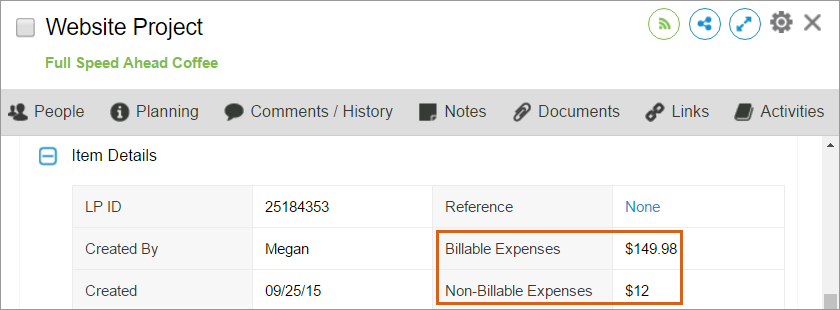

Enter expenses on tasks, events, and milestones in the Expenses section of the task’s edit panel. Describe the expense and enter a billable amount, non-billable amount, or both.

The line-item expenses roll up to billable and non-billable totals at the project and client level. You’ll see these roll ups in the Planning section of the project edit panel under item details.

All workspace members who have access to a project are able to add and view expenses.

Reporting on Expenses

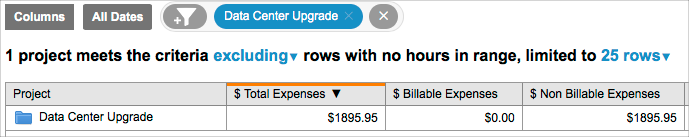

You can report on total expenses, billable expenses, and/or non-billable expenses a few different ways using Analytics or Dashboards. You can also export the totals from the Projects tab by using Export Tasks to File.

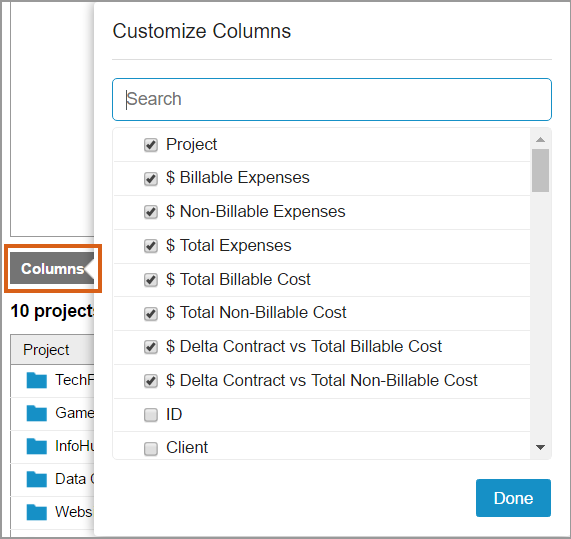

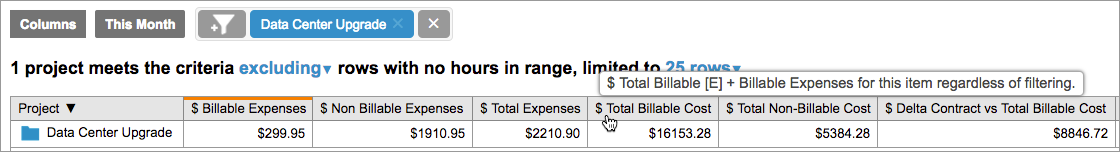

To see expense calculations in an Analytics report, click on Columns and check the boxes to select which columns you want exposed in the report. Expenses are calculated independent of date filters and available in Project Roll-up, Task Roll-Up, Custom Field Roll-Up, and Client Roll-Up reports.

On a Dashboard, these calculations are available in Analytics Table Widgets when the Row Type is set to Project, Task, Client, or Custom Field.

Expense Columns

Below is a brief overview of the columns that calculate expenses in Analytics and Dashboards. For the full list of columns, their definitions and how they’re calculated, follow this link: Column Definitions

These columns calculate the sum of the applicable expenses for each plan item row:

- $ Billable Expenses

- $ Non-Billable Expenses

- $ Total Expenses

These columns allow you to see the sum of expenses with other billable and non-billable labor costs for each item:

- $ Total Billable Cost = $ Total Billable [E] + Billable Expenses

- $ Total Non-Billable Cost = $ Total Non-Billable [E] + Non-Billable Expenses.

These columns calculate the amount by which the project Contract Value (Project Roll-Up) or client Contract Value (Client Roll-Up) exceeds or falls below the billable or non-billable costs for each row. Since the Contract Value is set at the project folder level, calculations including the contract value are not available in Task Roll-Up reports.

- $ Delta Contract Value vs Total Billable Cost

- $ Delta Contract Value vs Total Non-Billable Cost

This column calculates the amount by which the Total Billable Cost exceeds or falls below the Total Non-Billable Cost for a project or task (Project or Task Roll-Up report), or for all items with a specified custom field (Custom Field Roll-Up report) or for a client’s group of projects (Client Roll-Up report):

- $ Delta Total Billable Cost vs Total Non-Billable Cost

Keep in mind expense calculations do not include any pay rate metrics. To see pay rate calculations alongside the expense calculations, expose pay columns and export the report as a CSV for further analysis in Excel.

Helpful Hints

- If you’ve hired a temporary contractor at a fixed amount, consider entering the cost for the contractor as an expense rather than creating a virtual member and tracking billable time on their behalf.

- For projects that always require the same materials and corresponding costs, you can create a template project with the expenses pre-populated on specific tasks and duplicate the project as necessary.

Related Articles

Using Rate Sheets for Billing and Pay Rules

Clients

Analytics Roll-Up Reports

Dashboards